2030 sounds like a faraway sci-fi date , possibly the kind of year where people wear silver jackets and trade from Mars. But here’s the plot twist: it’s less than four years away. And if you blink, your CRM might still be trying to load a report while everyone else’s is holding board meetings with AI agents.

The truth is, the entire fintech world is sprinting toward automation, compliance-by-design, and instant everything. Payments are going real-time, AI is going autonomous, and even client onboarding is learning how to think. The forex CRM, that once humble back-office tool, is quickly morphing into the nerve center of the brokerage.

This article maps out where we are now, where the data says we’re heading, and what your back office could look like when 2030 rings the bell. Buckle up, we’re not predicting flying cars – at least not yet- but your CRM might just start thinking for itself.

2030 Forex CRM Features

1. AI Will Be Your Colleague

By 2030, your CRM won’t “have” AI , it is AI. Think of it as hiring a full digital team: one agent chases missing KYC docs, another reconciles payments in real time, another predicts which clients are about to ghost you.

This shift is already underway. Salesforce’s Agentforce and HubSpot’s new Customer and Prospecting Agents are not just assistants ; they actually do the work, cutting ticket-handling time by up to 40%. Fast-forward a few years and your CRM will come with its own “staff directory” of AI agents, all trained on your workflows, all fully auditable under the EU’s new AI Act.

Compliance won’t be an afterthought as it’ll be built into every prompt, every decision, every line of code.

2. The KYC Scavenger Hunt Finally Ends

By the end of the decade, KYC will feel less like chasing paperwork and more like tapping a badge. The EU Digital Identity Wallet, set for universal rollout by 2030, will let clients share verified data in seconds.

Instead of uploading blurry ID scans, traders will simply approve your CRM’s request to “access verified identity.” That’s it.

Meanwhile, Europe’s new Anti-Money Laundering Authority will oversee how this data moves, ensuring every transaction leaves a clean, auditable trail.

In other words: no more waiting days for verification. No more compliance ping-pong. Just instant trust.

3. Real-time Money Becomes the New Normal

In 2030, a “pending payment” will sound as outdated as “fax me the forms.”

The EU Instant Payments Regulation (phased in from 2025) will make 10-second euro transfers mandatory — at the same or lower cost as traditional ones. Combine that with the BIS Project Nexus, which is linking instant-payment systems across countries, and cross-border money movement will soon be as easy as sending a text.

For brokers, this means one thing: your CRM’s treasury system must run on ISO 20022-native rails, handling structured, data-rich transactions in real time. Anything slower will feel prehistoric.

4. OpenFinance Turns CRMs into Data Powerhouses

If open banking cracked the door open, open finance will blow it off its hinges. The EU’s FiDA framework and PSD3 will give brokers lawful, consented access to financial data across accounts, assets, and risk profiles and all directly through the CRM.

So instead of asking clients to “upload statements,” your CRM will simply fetch the verified data. Combine that with smarter segmentation and privacy-first profiling (because third-party cookies are basically toast), and your CRM will double as your most compliant marketing engine.

Think precision targeting without the creepy factor.

5. Resilience Moves from Policy to Product

Forget the ISO certificate framed on your office wall, because by 2030, resilience will be a live metric, not a marketing line.

Thanks to DORA, NIS2, and the new ISO 27001:2022 standards, regulators now expect brokers to prove operational strength, not just promise it. CRMs will simulate failovers, monitor every API dependency, and export full audit trails in seconds.

When an auditor asks for “resilience evidence,” you won’t start a six-week scramble, you’ll just click download.

6. Multi-asset by design (and maybe a hint of digital cash)

The forex CRM of 2030 won’t blink at a CBDC deposit. With over 90% of central banks experimenting and at least 15 retail CBDCs expected live by the decade’s end, digital fiat will quietly become part of daily settlements.

Add in crypto-asset regulation under MiCA, and your CRM will handle custody, travel-rule compliance, and digital asset reporting as natively as it now manages fiat transactions.

By then, the word “multi-asset” won’t be a selling point. It’ll be a baseline expectation.

How To Build Toward the 2030 CRM Future

If you’re planning your 2026–2030 CRM roadmap, aim for these milestones:

-

AI agents with compliance guardrails — explainable, auditable, role-based.

-

Wallet-ready KYC — eIDAS 2.0-compatible, travel-rule aware.

-

ISO 20022-native payment layer — structured data from deposit to withdrawal.

-

Instant-payment routing — SCT Inst and Nexus integration for true global reach.

-

Open-finance connectors — FiDA and PSD3-ready consent management.

-

Resilience by design — DORA metrics and exportable testing reports.

-

Built-in ISO 27001:2022 controls — not just a certificate.

-

Crypto & CBDC readiness — MiCA-compliant custody and reporting.

A Day in the life, 2030 CRM Edition

It’s a quiet Thursday night.

A trader in Milan tops up margin at 11:41 PM.

Your CRM’s AI Treasury Agent spots the instant SEPA transfer, tags it via ISO 20022 fields, and reconciles it automatically.

Your Onboarding Agent fetches the verified address from the EU identity wallet.

A compliance rule pings — the account hit a leverage threshold — the system adjusts exposure, logs the decision, and generates the audit trail before you can finish your coffee.

Zero panic. Zero spreadsheets. Just orchestration.

Long Story Short

By 2030, a forex CRM won’t just help you manage your brokerage but also help you run it.

It’ll analyze, act, verify, and reconcile faster than any team ever could, and it’ll do so transparently, securely, and within every regulation’s fine print.

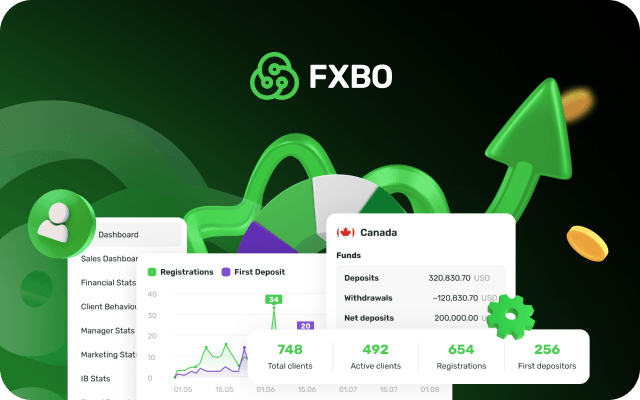

With FXBO CRM, we’re already building for that future. Our ISO-certified CRM, 400+ integrations, and automation-first architecture are designed to make your brokerage 2030-ready today — no time machine required.

Request a demo and see how your back office can evolve into the future, one smart automation at a time.