If global finance were a city, ESG would be the new urban masterplan, one that insists every street, skyscraper, and subway line be built with the planet and its people in mind. ESG stands for Environmental, Social, and Governance; a framework for measuring how companies and investments affect the world around them.

It’s no longer just about making money. It’s about how you make it and whether your profits come at the cost of environmental damage, social inequality, or poor corporate ethics.

In stock markets, ESG investing has been reshaping portfolios for years: funds favoring renewable energy companies, tech firms with ethical labor practices, or manufacturers with clean supply chains. But in the foreign exchange market, the largest and most liquid financial arena in the world, the concept is still finding its footing.

Currencies themselves don’t have smokestacks to clean up or waste to recycle. Yet the forces that move them—government policies, trade relationships, investor sentiment—are increasingly influenced by sustainability agendas. That’s where forex brokers come in. They can become the catalysts that translate ESG principles into actionable, tradeable strategies. The question is: will they lead this green shift, or simply watch it unfold?

Let’s unpack this question in 5 steps.

Step 1 – What ESG Really Means in Practice

Let’s unpack ESG before we bring it into the FX arena.

-

Environmental: How an entity impacts the planet; carbon emissions, renewable energy use, water management.

-

Social: How it treats people; employees, customers, suppliers, and the communities it affects.

-

Governance: How it’s run ; corporate ethics, transparency, anti-corruption practices, shareholder rights.

In equities, ESG is relatively straightforward: a company either aligns with these principles, or it doesn’t. In FX, it’s trickier. A currency is a reflection of an entire country’s economic health, policy choices, and political will. This means ESG in forex often focuses on data-driven indicators:

-

Countries investing heavily in renewables.

-

Nations improving social equality and labor rights.

-

Governments with transparent fiscal policies and strong rule of law.

These factors influence currency value over the long term and can be built into trading strategies.

Step 2 – How Brokers Bring ESG into FX

Brokers are the market’s architects. They don’t just provide a platform for buying and selling currency pairs but also choose the tools, research, and products traders can access.

Some are already integrating ESG into their offering:

-

ESG-linked instruments: green bonds, sustainability-focused ETFs, or indices that track currencies from ESG-strong nations.

-

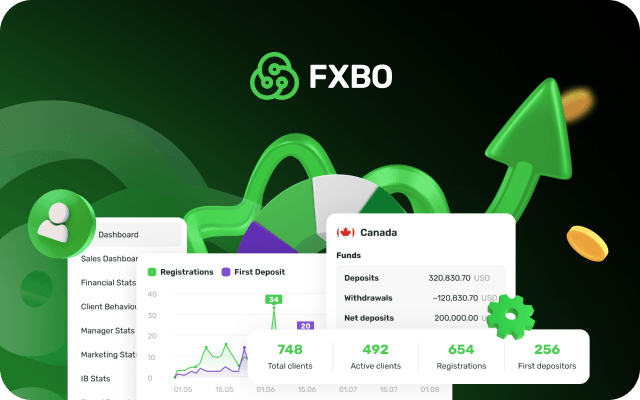

Analytics dashboards: overlays that track a country’s renewable energy investments, human rights scores, or governance rankings alongside price charts.

-

Thematic portfolios: curated currency baskets tied to sustainability themes, such as “Renewable Energy Leaders” or “Transparent Governance Economies.”

By embedding ESG into the FX experience, brokers move sustainability from a “stock market trend” into the heart of currency trading.

Step 3 – Real-World Examples

The shift isn’t theoretical since it’s already underway.

-

Norwegian Krone (NOK): Norway’s aggressive renewable energy investments and electric vehicle adoption have become macroeconomic drivers that influence the NOK’s performance.

-

Swiss Franc (CHF): Switzerland’s policies on carbon neutrality and corporate governance add an ESG halo to its currency stability.

-

Canadian Dollar (CAD): Canada’s social equity programs and resource management strategies factor into long-term investor sentiment.

Forward-thinking brokers use these narratives to create ESG-focused trading products that give traders the option to back currencies that align with their values.

Step 4 – The Opportunities and the Pitfalls

Opportunities for brokers:

-

Market differentiation – Standing out in a crowded FX market with ESG integration.

-

New client segments – Attracting sustainability-conscious traders and institutions.

-

Partnership potential – Collaborating with ESG data providers for exclusive insights.

Pitfalls to avoid:

-

Greenwashing – Offering “ESG” products with no measurable sustainability metrics.

-

Regulatory uncertainty – ESG standards vary widely by region and are evolving fast.

-

Data complexity – Assessing an entire country’s ESG performance is far more complex than rating a single company.

Step 5 – Why Now Is the Moment

The momentum is undeniable. Global ESG investments surpassed $30 trillion in 2022 and continue to grow and could surpass $40 trillion by 2030. This capital is shaping investor behavior across asset classes—and forex won’t be immune.

Brokers who lead now can:

-

Build ESG credibility while standards are still forming.

-

Shape client expectations around sustainability in currency trading.

-

Position themselves as thought leaders in a niche that’s about to scale.

Brokers as the Architects of a Greener FX

Forex may never be “green” in the same way as solar farms or zero-emission vehicles. But that’s not the point. The green shift in FX is about aligning the largest financial market in the world with the forces shaping its future: climate policy, social equity, and transparent governance.

Brokers are perfectly positioned to lead this revolution. Not by forcing traders to change their strategies, but by giving them the tools to align profit with principle. And in a market where speed, innovation, and differentiation are everything, waiting on the sidelines might be the riskiest trade of all.

If you’re a broker looking to bring ESG into your strategy, now is the moment to act. Innovation starts with the right foundation, an ISO-certified FXBO CRM built to handle market data, analytics, and compliance in one place. Equip your brokerage for the future and stay ahead of the competition.

Request your free demo today and see how FXBO can transform your operations.