What does an airport have in common with a brokerage?

At first glance, not much. One moves planes, while the other moves trades.

Look closer and the resemblance starts to make sense.

Both operate at scale, live under constant regulatory pressure, and depend on timing, coordination, and systems that must work even when humans don’t.

And in both, real disasters start with delays, handoffs, or someone still checking a spreadsheet while momentum quietly takes off without them.

That is the uncomfortable truth of brokerage operations in 2026. The most expensive thing inside a brokerage today is the lack of automation.

This is where automation strategies start becoming crucial for operational survival. That’s precisely where FXBO CRM earns its relevance, not by shouting features, but by quietly running the operation like an air-traffic control system brokers forgot they needed.

Why Automation Strategies Matter More Than Speed in 2026

Everyone says they want speed, but what they need is flow without friction. In plain words: a tight automation strategy that only comes with the right CRM.

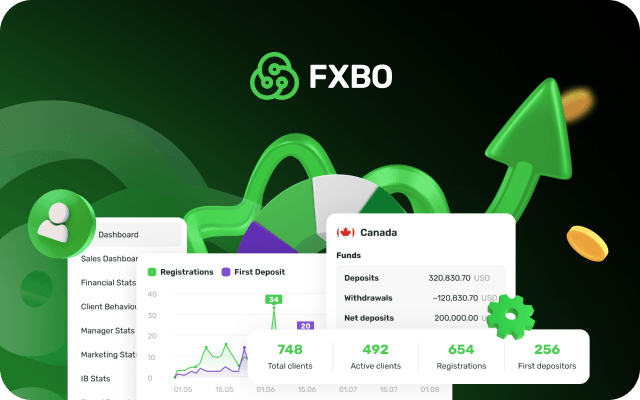

FXBO CRM is built around that idea; from onboarding to compliance, sales to IBs, marketing to reporting, everything runs inside one environment.

That architecture matters because FXBO connects to 370+ integrations across trading platforms, payment providers, KYC vendors, VOIP systems, analytics tools, and partner services.

Gartner predicts that by 2026, nearly 30% of enterprises will automate more than half of their operational activities, a sharp rise from well under 10% just a few years earlier. At the same time, around 50% of organizations are expected to run AI-driven orchestration platforms, turning fragmented systems into coordinated workflows rather than disconnected tools.

The Control Tower: 6 Automation Strategies Enabled by FXBO CRM

1.Onboarding Without Bottlenecks

Most brokers lose clients at the same place airports lose passengers: security.

Not because it exists, but because it feels endless.

FXBO CRM automates onboarding as a continuous clearance process, not a series of stop signs.

-

KYC and document verification are triggered automatically.

-

Clients receive reminders without support teams chasing them.

-

Status updates are visible in real time across departments.

The client never wonders, “Did they receive my document?”

The team never asks, “Where is this user stuck?”

2.Sales Follow-Up That Doesn’t Feel Robotic

Sales teams fail when they become air-traffic controllers by accident.

Forget the chaos of manual lead assignment, forgotten follow-ups,and status updates scattered across tools.

FXBO CRM automates sales workflows so reps focus on conversations, not coordination.

-

Leads are distributed automatically.

-

Follow-ups trigger based on behavior, not guesswork.

-

Client statuses update the moment activity changes.

3. IB Networks Without Spreadsheet Drama

IB networks often look like budget airlines run on spreadsheets.

Everyone swears the numbers are right, but no one is fully confident.

FXBO treats IBs as a scheduled route system.

-

Commission structures are predefined.

-

Tier logic is automated.

-

Payouts are calculated and tracked inside the CRM.

-

IBs can easily transfer funds to their referrals with ease

IBs don’t need to ask when they will be paid and brokers don’t need to explain how numbers were calculated.

Trust increases not because people communicate better, but because the system leaves less room for doubt.

4. Marketing That Triggers at the Right Moment

Bad marketing automation is like boarding announcements that never stop.

FXBO’s approach is quieter.

Marketing actions are event-driven:

-

First deposit completed.

-

Inactivity detected.

-

Loyalty milestone reached.

Emails, bonuses, cashback, and campaigns trigger only when relevant.

Not because “it’s Tuesday.”

This matters because FXBO includes built-in tools for loyalty programs, cashback logic, and campaign automation, all tied to real client behavior.

That is how retention is built without annoying the people you are trying to keep.

5. Compliance That Runs in the Background

Compliance is the control tower you only notice when something goes wrong.

FXBO CRM automates compliance and reporting so it stays where it belongs: in the background.

-

Regulatory reports are generated automatically.

-

Client data is structured consistently.

-

Audit readiness is not a last-minute scramble.

6. Data Automations Driven by Real Activity

Many brokers treat data like a black box recorder, which is only useful after the crash.

FXBO CRM treats data like live radar.

Client activity, trading behavior, funding patterns, and engagement signals feed automation in real time. Integrations with trading platforms and analytics tools ensure the CRM reacts as events happen, not weeks later in a report.

That means:

-

Dormant clients trigger re-engagement.

-

Active traders unlock loyalty logic.

-

Risk signals surface before damage spreads.

The system doesn’t predict the future, for it simply notices the present faster than humans can.

Automation Strategies Are Only as Good as Your CRM

In 2026, automation is not a feature you install, rather an operating philosophy.

Automation strategies are the lifeblood of a brokerage, and once you experience a brokerage that runs like a well-managed airport, going back to manual coordination feels odd, unimaginable, and unacceptable.

But do you have the right CRM for it?

FXBO CRM’s numbers tell the story without needing embellishment:

-

15+ years of CRM expertise shaping brokerage workflows

-

250+ satisfied clients worldwide and Trusted by over 250 top brands across jurisdictions and business models

-

370+ live integrations, connecting trading, KYC, analytics, and infrastructure

-

340+ payment providers, already wired into the system

-

ISO 27001:2022 certified, safeguarding your data and delivering secure services

It’s never too late to make the right decision this year and switch gear to the ultimate Forex CRM. In fact, before engaging in a full commitment, you can request a free demo right now!