Launching a forex brokerage in 2025 isn’t just about entering a competitive market—it's about choosing your battleground. And when it comes to forex, there are two powerful arenas you might consider stepping into: STP (Straight-Through Processing) and ECN (Electronic Communication Network).

Picture this: if traditional brokerage models are department stores (carefully curated and marked-up) then STP brokerages are sleek Airbnb rentals, straightforward and efficient. Meanwhile, ECN brokerages? Think bustling bazaars, raw, transparent, and buzzing with unfiltered activity.

But how do you choose between these two modern, appealing brokerage types?

Let’s dive deeper.

What Exactly are STP and ECN Brokerages?

Both STP and ECN brokerages connect traders directly with liquidity providers, removing the dealing desk. Yet, subtle differences shape their identities and impacts.

-

STP (Straight-Through Processing) brokers forward orders directly to liquidity providers—banks and prime brokers—and earn from competitive spreads or modest commissions.

-

ECN (Electronic Communication Network) brokers match client trades directly with other market participants—banks, institutions, hedge funds—often offering raw spreads and charging transparent commissions per trade.

How STP and ECN Forex Brokerages Compare :

Transparency and Trader Trust

Transparency reigns supreme in 2025. Modern traders aren’t just demanding honesty—they require undeniable proof.

-

STP: Transparency is clear. While spreads can be slightly marked-up, there's no conflict of interest or hidden dealing desk interference.

-

ECN: Offers the ultimate transparency—raw market pricing, zero spread markups, and clear commissions per trade. No hidden surprises.

Winner: ECN, for those who crave ultimate transparency and raw pricing.

Execution Speed

Latency in forex trading is like stale bread—it won’t sell.

-

STP: Fast execution as trades route directly. Typically under 100 milliseconds, keeping clients content.

-

ECN: Blazing-fast, usually sub-50 milliseconds. Essential for high-frequency traders who won’t tolerate delays.

Winner: ECN, if your traders are hyper-speed-focused.

Pricing Models: Spread vs. Commission

Traders in 2025 scrutinize every fraction of a pip.

-

STP: Earns primarily via competitive, slightly marked-up spreads. This simplicity can appeal to traders who prefer predictable pricing.

-

ECN: Raw spreads, extremely tight, paired with clear, per-trade commissions. Ideal for traders demanding maximum cost-efficiency.

Winner: Depends on trader preference—predictable (STP) vs. ultra-competitive (ECN).

Liquidity and Market Depth

Both brokerage types rely heavily on deep liquidity.

-

STP: Usually aggregates liquidity from fewer but highly trusted sources. Ensures reliability, but occasionally less depth.

-

ECN: Pulls from a broader, diverse network of liquidity providers, generally offering deeper market depth, crucial during market volatility.

Winner: ECN, for broader market access.

Revenue Generation and Trader Behavior

Understanding trader psychology helps you pick the right model.

-

STP: Predictable revenue streams from steady traders who appreciate simplicity and reliable execution.

-

ECN: Higher volumes, often frequent trades. Traders attracted to ECN are typically active, high-frequency participants, meaning potentially greater total revenue.

Winner: ECN, if volume and frequency are priorities.

Regulatory and Setup Considerations

Compliance and setup can be significant deciding factors.

-

STP: Generally easier and slightly less expensive to set up. Regulatory requirements might be less burdensome.

-

ECN: Heavier regulatory scrutiny due to raw-spread execution. Setup might require greater initial investment and stringent compliance.

Winner: STP, for brokers preferring lower entry barriers and simplified compliance.

STP Vs. ECN: Common Pitfalls to Avoid

-

STP Pitfalls:

-

Misrepresenting execution speed and liquidity depth.

-

Underestimating trader demands for transparent pricing.

-

ECN Pitfalls:

-

Offering pseudo-ECN models with hidden routing. Traders in 2025 see right through "fake ECN."

-

Underestimating infrastructure requirements. ECN traders demand seamless, ultra-fast tech.

Which Forex Brokerage Model Should You Choose?

Ah the question you’ve been waiting for. Well, choosing between an STP or ECN brokerage in 2025 isn't simply about preference, it's about aligning your business objectives with clear trader profiles and operational realities. Here's a detailed breakdown to help you make a smart, informed decision:

Choose STP if:

-

Your target audience includes beginners to intermediate traders:

STP provides a straightforward and easily understandable fee structure, ideal for traders who prefer predictable costs.

-

You value simpler operational setup:

STP brokerages typically face lower barriers to entry in terms of setup complexity, technology requirements, and regulatory scrutiny, allowing for faster market entry.

-

Reliability and Consistency are your selling points:

Traders who prefer stable and predictable market conditions with fewer surprises often find comfort in STP's moderately marked-up but clear spreads.

-

Budget and Resources are Limited:

STP setups generally demand fewer initial investments in technology infrastructure and liquidity partnerships, making it an attractive option if you're starting with limited resources.

Choose ECN if:

-

Your ideal traders are experienced, active, or institutional participants:

ECN caters to professional traders and institutions that require extremely tight spreads, transparent pricing, and precise execution.

-

Transparency is paramount for your client base:

ECN's raw spreads, with clearly defined commissions per trade, leave no room for doubt or suspicion. Ideal for markets where trust through transparency is non-negotiable.

-

Execution speed is critical:

ECN brokerages thrive on delivering executions measured in milliseconds—essential for attracting algorithmic traders, scalpers, and high-frequency traders who tolerate zero delays.

-

Your business can handle higher regulatory and technological requirements:

ECN operations are resource-intensive, requiring robust technology, higher compliance standards, and deep liquidity pools to maintain credibility and trader satisfaction.

LONG STORY SHORT?

If you want to launch fast, keep things simple, and attract everyday traders who just want a smooth, reliable experience, STP is your best bet. But if you’re aiming to impress the pros—those high-frequency, no-nonsense traders who care about raw pricing, lightning speed, and total transparency—then ECN is where you want to be.

Choose the model that fits not just your business plan, but the kind of traders you want cheering you on.

Final Thoughts: Your Brokerage, Your Battleground

Launching either an STP or ECN forex brokerage in 2025 places you in an exciting, competitive landscape. Both models cater to the modern trader's demand for transparency and efficiency.

Whichever path you choose, ensure your infrastructure, liquidity connections, and compliance measures are impeccable.

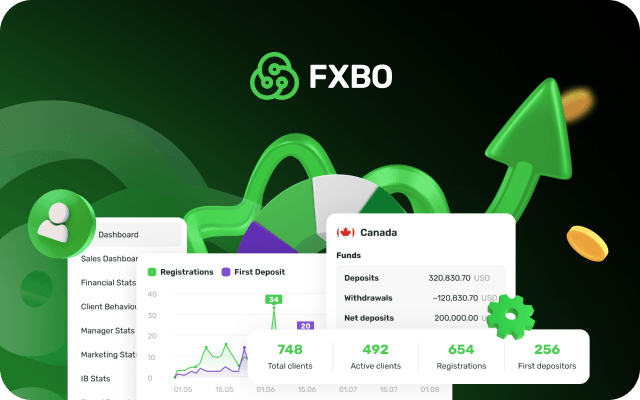

Whether you choose an STP brokerage model or an ECN brokerage one, you are going to need a powerful Forex CRM to run the business smoothly. Here's where the old trusty ISO-certified FXBO CRM steps in with its impressive, tailored solutions from precise analytics, customization, to smart insights and more.

Ready to take your brokerage from concept to reality? Request your FXBO demo today and step confidently into the future of forex trading!