The forex market is one of continual fluctuation and opportunity. Investors and traders are constantly in search of systems and tools that amplify profits while mitigating risks. At the heart of this quest for optimization are two notable techniques: PAMM and Copy Trading. But what sets these approaches apart, and which is better suited to maximize profitability in the high-stakes world of the forex market?

Understanding PAMM and Copy Trading:

PAMM, or Percentage Allocation Management Module, is a method of investment in the forex market where investors allocate their capital to a trader's fund. The trader then makes all the trades to grow the fund in exchange for a percentage of the profits (or sometimes a separate fee). Copy Trading, on the other hand, is a method that allows retail clients to 'copy' the trades of more experienced traders. This form of trading can be performed manually or through dedicated platform utilities.

Both methods offer opportunities for passive investment and learning from seasoned traders.

Advantages of PAMM and Copy Trading:

PAMM provides passive investment opportunities, potential for significant profits, and risk management by professional fund managers.

Copy Trading offers accessibility, learning opportunities, and customizable risk control.

Comparative Analysis:

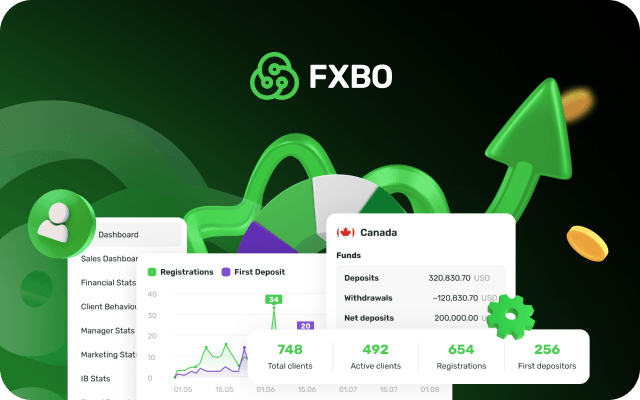

Both PAMM and Copy Trading can be lucrative, with PAMM offering managed portfolios and potential gains, while Copy Trading provides customization and control. Integration of both methodologies within a Forex CRM like FXBO ensures a well-rounded trading strategy.

Profitability Evaluation:

FXBO integrates both PAMM and Copy Trading, providing comprehensive solutions for optimizing forex operations. PAMM and Copy Trading each offer compelling strategies for navigating the complex waters of the forex market. While the allure of passive management with PAMM might appeal to some, the collaborative and customizable nature of Copy Trading has its own merits. The decision between the two should be based on individual investment goals, risk tolerance, and the specific market conditions.

Recommendations and Further Learning

Ultimately, the best approach may not be an either-or decision, but a combination of both for a well-rounded forex trading strategy. This approach allows for the passivity and professional oversight of PAMM, supplemented by the hands-on learning and control that Copy Trading offers.

For those ready to take the plunge, begin by researching and partnering with reliable forex CRM platform that can facilitate the structural complexities of PAMM and Copy Trading. Continually educate yourself on market trends, and never stop refining your trading strategy. In a world where even a fraction of a second can be the difference between profit and loss, staying ahead is not just an advantage — it's a necessity.

Is your enterprise considering leveraging PAMM or Copy Trading to optimize forex operations? Partner with a reliable forex CRM provider like FX Back Office (FXBO) can streamline the complexities of PAMM and Copy Trading. Continual education on market trends and strategy refinement are vital for success in forex trading. FX Back Office offers tailored solutions to empower brokers in optimizing forex operations. Integration of PAMM and Copy Trading within FXBO is facilitated through Brokeree, enhancing efficiency and effectiveness in forex operations. Connect with us to discover how our platform can elevate your forex endeavors and drive superior results.