If the last few years taught the forex industry anything, it is that stability is a myth, and resilience is a strategy. Markets swing; regulations shift, payment rails wobble, and client expectations evolve at the speed of TikTok trends. In this noise, the brokers who stay upright are not the ones who muscle through. They are the ones who automate, anticipate, and adapt.

This article explores how automation transforms operational resilience for forex brokers, how it strengthens margins, how it protects the business when volatility spikes, and what parts of your back office should have been automated yesterday.

Why Resilience Is the Broker’s Real Competitive Edge

The forex market is designed to test reflexes. But a brokerage should not run on reflexes alone, because human-powered processes slow down just when you need the most clarity.

Operational resilience is your brokerage’s ability to continue serving clients during stress. Not surviving, but performing. Not patching holes, but maintaining flow.

Every second of downtime affects:

-

Deposits and withdrawals

-

Client onboarding

-

Compliance cycles

-

Trade flow

-

Retention

-

Partner management

-

Support load

In other words, the entire organism.

Automation is not about replacing people. It is about making sure your business does not collapse the moment things get loud.

Automation as Your First Line of Defense

Think of automation as the silent machinery that absorbs shock before it even reaches your team.

Here are the areas where automation becomes a resilience multiplier:

1. Onboarding That Never Breaks Under Pressure

Manual onboarding is slow, inconsistent, and vulnerable when volumes spike. Automated onboarding creates:

-

KYC verification flows that adapt to region

-

Rule based approval paths

-

Instant risk categorization

-

Automatic notifications and document capture

The result is an onboarding process that runs at the same speed as 50 clients or 5,000 clients.

2. Payments That Keep Moving Even When Markets Don’t

Volatile markets expose fragile payment flows. Automation helps brokers:

-

Route payments through the safest available PSPs

-

Detect abnormal patterns or blocked transactions instantly

-

Auto trigger fallback payment options

-

Reconcile transactions across multiple providers

Payment stability is a non-negotiable part of resilience. Without it, your deposit funnel collapses and with it, your revenue.

3. Compliance Workflows That Scale Instead of Snapping

Compliance gets harder during turbulence. Volatility means more PEP checks, more AML alerts, more suspicious patterns, and more pressure from regulators.

Automated compliance lets you:

-

Set risk scoring rules

-

Auto escalate alerts

-

Lock accounts based on suspicious activity

-

Streamline document management

-

Keep audit trails accurate and complete

When your compliance is automated, you are not scrambling to catch up. You are proving control.

4. Partner Management That Does Not Collapse at Peak Hours

IBs and affiliates bring traffic in unpredictable waves. Automation ensures:

-

Real time commission calculations

-

Automatic validation of referred accounts

-

Instant reporting

-

Accurate payout scheduling

You cannot afford manual partner management when your business depends on referral volume.

5. Client Support That Stays Human While Automation Does the Heavy Lifting

Support suffers during chaos. But automated routing, ticket categorization, data surfaced directly from your CRM, and prebuilt action flows reduce the load by half.

Your team becomes problem solvers instead of firefighters.

When Markets Get Turbulent, Human Workflow Is the First to Fail

Every brokerage suffers from the same Achilles heel. Manual tasks pile up. A single bottleneck slows the entire pipeline. A misrouted payment creates a chain reaction. A forgotten compliance alert becomes a regulatory headache.

Stress does not create weaknesses. It exposes them.

Automation seals those cracks before they turn into structural failures.

When brokers automate critical back-office workflows, the payoff isn’t just speed it’s precision and reliability. Research shows financial automation can cut reporting errors by up to 90% and enable teams to complete processes 85 times faster, directly bolstering resilience when turbulence hits.

How Brokers Can Automate Without Losing Control

You do not need to automate everything at once. But you should automate the parts that break first.

Start with:

1. A CRM Engine Built for High Volume Velocity

If your CRM cannot adjust, nothing else can. You need automated flows for KYC, approvals, payments, partner management, segmentation, and risk scoring.

2. A Single Source of Truth for Client Data

Resilience depends on visibility. Without centralized data, your team works blindly.

3. API Driven Connectivity with PSPs, Trading Platforms and RegTech Tools

Automation only works if your systems talk to each other.

APIs keep your entire brokerage alive even when one system slows down.

4. Real Time Monitoring for Operational Health

You cannot fix what you cannot see.

Real-time alerts and dashboards prevent damage before it spreads.

5. Automated Escalation Paths

When something breaks, the system should know who gets notified, what action is triggered, and what gets logged.

The Hidden ROI of Automation During Turbulence

Most brokers measure ROI in deposits, conversions, and CPA. But automation brings a quieter, deeper ROI:

-

Fewer errors

-

Fewer chargebacks

-

Fewer compliance incidents

-

Fewer support escalations

-

Fewer manual interventions

-

Faster client journeys

-

Stronger partner engagement

In short, steadiness in chaos and steadiness is a competitive advantage.

The Brokers Who Survive Are the Ones Who Automate

Agility is not speed. It is controlled speed.

Operational resilience is not strength. It is adaptability.

In turbulent times, automation is not optional. It is how brokers stay predictable in an unpredictable market, how they maintain service when demand spikes, and how they operate with clarity while competitors panic.

The world is not calming down. The markets are not slowing down. The regulators are not relaxing. But your systems can be ready.

If resilience is the future of brokerage success, automation is the machinery that makes it real.

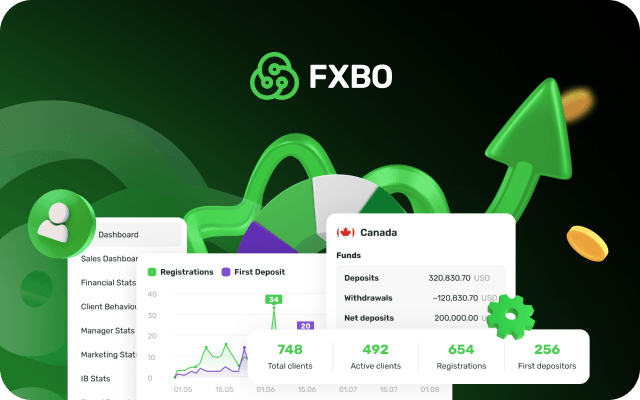

If you want your brokerage to stay sharp, stable and scalable no matter how chaotic the market becomes, you need technology built for resilience, not just routine. FXBO CRM automates the bottlenecks, fortifies your workflows and keeps your entire operation moving with precision. Request a free demo and see how FXBO turns resilience into your competitive advantage.