If the traditional forex brokerage model is like running a department store (controlled pricing, marked-up goods, and a middleman for everything) then launching an ECN brokerage in 2025 is like opening the doors to a raw, unfiltered trading bazaar. No polished sales reps. No fancy packaging. Just real buyers, real sellers, and real-time action.

And guess what?

Modern traders love the bazaar.

In a world where transparency is currency, and speed is survival, the ECN model is no longer a niche. It’s a strategic necessity for brokers who want to compete in a market filled with lightning-fast decisions, data-rich traders, and zero tolerance for old-school markups.

So, if you’re thinking about launching an ECN brokerage in 2025, here’s what you actually need to know.

Let’s Start with the Basics: What Is an ECN Broker, Really?

An ECN (Electronic Communication Network) broker doesn’t play middleman — it plays matchmaker.

Instead of holding the other side of your client’s trade, an ECN broker connects traders directly to a pool of liquidity providers — think banks, hedge funds, institutions, and other traders — all in real time.

There’s no price manipulation, no dealing desk, and no artificial spreads.

Just raw, transparent pricing and lightning-speed execution.

In return? ECN brokers charge a small, flat commission per trade. Traders know exactly what they’re paying, and exactly what they’re getting — which in 2025 is the fastest way to build trust in a skeptical market.

Why ECN Is the Brokerage Model Traders Actually Trust in 2025

Modern traders aren’t just tech-savvy — they’re comparison-obsessed.

They want proof. Screenshots. Spreadsheets. They want to know they’re not being scammed by inflated spreads or delayed executions.

That’s where ECN shines.

Here’s why launching an ECN brokerage today isn’t just trendy — it’s tactical:

-

Transparency = Trust

All trades flow straight to the market. No dealing desk. No conflicts of interest. No broker “magically” winning when a client loses.

-

Tighter Spreads, Better Execution

ECN platforms aggregate quotes from multiple liquidity providers — meaning your clients get ultra-competitive bid/ask pricing.

-

Speed Is Baked In

In ECN trading, latency is the enemy. 2025 traders expect execution within milliseconds. Any slower, and your brokerage looks like it runs on dial-up.

-

More Volume, More Revenue

Since you charge commissions (not markups), higher volumes = better business. And ECN clients tend to trade often — they like action.

What You Actually Need to Launch an ECN Brokerage in 2025

Starting an ECN forex brokerage isn’t a plug-and-play situation. You need strategy, infrastructure, and a bulletproof compliance game.

Let’s break it down:

1. Regulatory Approval

Before you take your first trade, get licensed. Regulators in 2025 are stricter than ever, especially with the rising popularity of raw-spread models. Jurisdictions like Cyprus, the UK, or Mauritius each come with their own rules, costs, and perks.

Pro tip: Pick a region that balances credibility with cost-efficiency — your brand reputation depends on it.

2. Connect to Deep Liquidity

You’re not the dealer anymore — you're the bridge.

You’ll need strong relationships with tier-1 liquidity providers (banks, hedge funds, prime brokers) to give your clients the best execution and fill rates.

Don't go cheap here — unreliable liquidity is like serving sushi without refrigeration. Dangerous and reputation-killing.

3. The Right Tech Stack

You’ll need:

-

A trading platform that supports ECN routing (MetaTrader 5 with bridge tech or cTrader is common).

-

Smart order routing systems.

-

Real-time risk and execution monitoring.

Bonus points for offering:

-

Client-side analytics.

-

Low-latency mobile platforms.

-

Lightning-fast trade confirmations.

4. A Commission Structure That Makes Sense

You’re not marking up spreads anymore — so define your value in terms of execution quality and platform features. Keep your commissions transparent and competitive.

Common Pitfalls (So You Can Avoid Them Like a Pro)

-

Overpromising Execution Speed

If your tech stack lags, your clients won’t wait. They'll bounce to a broker who can execute at the speed of light.

-

Underestimating Client Expectations

ECN clients are sharp. They compare pricing. They sniff out slippage. If your setup isn't rock solid, they'll call you out.

-

Trying to Fake ECN

Don’t even think about offering “ECN-style” accounts with shady routing. 2025 traders aren’t stupid — they’ll see through it in one click.

Final Thoughts: ECN Isn’t a Shortcut — It’s a Strategy

Launching an ECN brokerage in 2025 is like stepping into the arena with the gloves off.

You’re offering transparency, speed, and raw market access — and if you do it right, traders will love you for it.

But make no mistake: you need the right foundation.

That means legit compliance, deep liquidity connections, and a trading infrastructure that doesn’t flinch when the market moves.

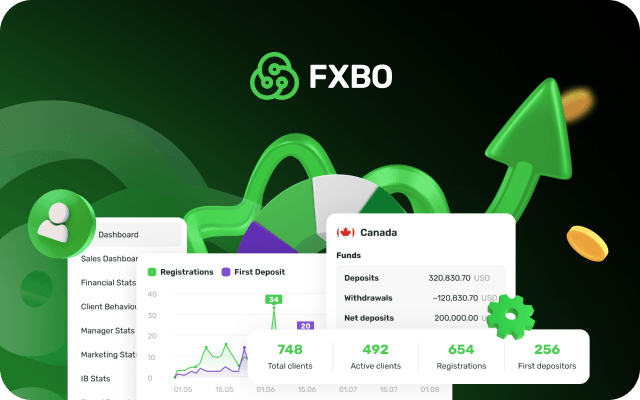

Want a CRM that’s built for brokers operating at ECN speed?

FXBO CRM delivers the automation, data control, and client insights you need to thrive in a raw-spread, high-frequency world. Request a demo today!