Remember when compliance felt like the quiet guest at the party; slipping in with a checklist, tapping their pen, and then leaving you to get on with the fun? Well, in 2025 that guest has taken the microphone, turned up the lights, and is asking for receipts.

Regulators aren’t interested in what you plan to do anymore. They want to see the evidence: dashboards, logs, vendor registers, and real-world tests that prove your brokerage can survive a hit without clients losing faith or funds.

So, what exactly is on their shopping list for 2025? Let’s break it down.

1. Operational Resilience: Survive the Storm, Don’t Just Forecast It

-

EU: The Digital Operational Resilience Act (DORA) kicks in 17 January 2025. Brokers need to show they can handle ICT incidents, classify them, report them, and keep a full register of every tech vendor—from your CRM to your payments provider. If you’ve been running vendor contracts out of inbox threads, that stops here.

-

UK: The FCA and PRA’s Operational Resilience transition ends 31 March 2025. Translation? You can’t just identify your “important business services” (deposits, withdrawals, trading access), you have to prove you can keep them within tolerance during chaos.

Long story short: if your PSP goes down during Non-Farm Payrolls Friday, regulators want you to keep client withdrawals moving, not send apology emails.

2. Consumer Duty: Proof Beats Promises

UK-facing brokers already know the drill: the FCA’s Consumer Duty isn’t a one-time project, it’s a lifestyle. In 2025, the focus is squarely on embedding outcomes:

-

Are your products genuinely fair value?

-

Are you monitoring outcomes across client segments (new vs. experienced, retail vs. corporate)?

-

Can you show you support vulnerable customers and not just claim you do?

This isn’t about slogans. It’s about showing the receipts with data.

3. AML & the Crypto Travel Rule: The Devil’s in the Data

If your business touches crypto in any way, the EU’s Travel Rule (live since 30 December 2024) is now your reality. You must collect and transmit originator/beneficiary data for crypto transfers and verify self-hosted wallets over €1,000.

Even without crypto, KYC/AML expectations keep climbing. Regulators want risk-based workflows, automated refresh cycles, and clear escalation paths.

In 2025, compliance isn’t about slowing clients down, it’s about proving you know your clients without making them wait three weeks for an account.

4. CFD/FX Conduct: Same Rules, More Spotlight

Leverage caps, prominent risk warnings, negative balance protection, and restrictions on inducements are still the law of the land. What’s new? Regulators are zooming in on marketing.

If your affiliate or influencer promises “easy profits,” expect questions. If your risk warning is buried in grey text at the bottom of a landing page, expect heat.

Think of your risk warning as a seatbelt: visible, obvious, and saving you from disaster when it matters most.

5. Third-Party & Vendor Risk: Your Outsourcing Is Their Business

Every broker runs on third parties from PSPs, KYC providers, and liquidity bridges. In 2025, regulators expect you to map, monitor, and if necessary, exit those relationships cleanly.

That means:

-

A central vendor register

-

Backup PSPs and KYC providers (tested, not just listed in a policy)

-

Exit strategies that work in real life, not just on paper

6. Client Money & Withdrawals: The Reputation Maker

Segregated funds, reconciliations, and timely payouts are nothing new. But in 2025, regulators are watching how you handle payout resilience. If your primary PSP fails, clients still expect withdrawals.

Remember: nothing erodes brand trust faster than a client tweeting “My money is stuck.”

The Broker’s 30-Day Compliance Sprint

Want to stop sweating when regulators knock? Here’s what you can do this quarter:

-

Map critical services → Identify deposits, withdrawals, onboarding, and trading as “important business services.”

-

Build your vendor register → From PSPs to CRMs, with sub-outsourcing and exit plans.

-

Audit your risk warnings → Make them bold, clear, and mobile-first.

-

Automate KYC refreshes → Risk-based, with fail reasons tracked in dashboards.

-

Run a failover drill → What happens if your main PSP is offline during peak trading?

The Quiet Truth: Compliance Is Branding

Here’s the secret regulators won’t say out loud: compliance isn’t just about rules, it’s about reputation. Traders don’t see your vendor registers or resilience playbooks, but they feel them. They feel it when onboarding is quick, payouts never fail, and support knows their history.

That’s why 2025 compliance isn’t a burden, but rather a brand advantage.

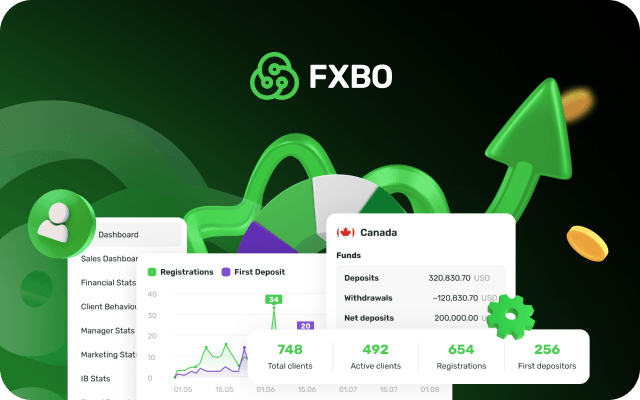

At FXBO, we don’t just help brokers grow, we help them grow without tripping over compliance wires. Our CRM brings your onboarding, KYC, payments, and IB portals into one place: automated, transparent, and regulator-ready.

Curious how a CRM can double as your compliance wingman? Book a free FXBO demo today and see how we turn regulatory checklists into business confidence.