If you think about it, every trade begins in the same place; not on a chart, not in an account, but in the human mind. A trader doesn’t just buy or sell currency pairs; they buy into beliefs, impulses, and fears.

For brokers, that means your job isn’t only about spreads, onboarding, and retention, but also about understanding the psychology behind every click. And that’s exactly where behavioral finance and Forex CRM intersect: turning trader behavior into a blueprint for smarter broker tools.

The Trader’s Mind: Logic May Trade, but Emotion Decides

The market is a mirror as it reflects more than price, also emotion.

Every surge of greed, every flicker of hesitation, every late-night “one last trade” moment is behavioral finance at work.

Some of the biggest biases behind trader behavior include:

-

Loss Aversion: Losing $100 hurts more than winning $100 feels good.

-

Overconfidence: A few good trades and suddenly the trader feels bulletproof.

-

Recency Bias: The last candle dictates the next decision.

-

Herd Mentality: “Everyone’s buying gold; maybe I should too.”

Imagine a trader who wins three trades in a row and suddenly increases lot size tenfold. The data calls it a “volume spike,” but psychology calls it euphoria bias. Another trader avoids re-entering the market after a losing streak; the CRM labels them “inactive,” but psychology calls it loss-avoidance freeze.

Your CRM could be watching these patterns happen.

The real question is: does it know why?

The Broker’s Challenge: Turning Behavior into Strategy

Traditional Forex CRMs focus on data. Smart ones focus on meaning, because the trader’s brain is where the real volatility lives.

A behavior-aware broker platform can:

-

Detect mood swings through trading frequency and volume shifts.

-

Spot early burnout from declining engagement and dormant accounts.

-

Personalize communication to fit the trader’s current mindset.

You’re not just managing accounts; you’re managing human patterns, from the highs of overconfidence to the lows of fear.

And that’s the real differentiator between a CRM that just stores data and one that helps interpret it.

From Psychology to Product Design: Building Behavior-Aware Broker Tools

So, how do you practically translate psychology into product features in a Forex CRM?

1. Segment traders by behavior, not just balance.

Tag them by their emotional patterns:

-

The Impulsive Trader — high trade count, short intervals.

-

The Analyzer — few but large trades, long deliberation time.

-

The Hesitant Starter — deposits but rarely opens positions.

Each persona must trigger a different workflow in your CRM.

2. Automate behavioral triggers.

-

A sudden lot-size jump? Send an automated message: “Consider scaling gradually to protect your gains.”

-

Inactivity after losses? Offer a “confidence-rebuild” campaign or market insights designed to re-engage.

-

Overtrading detected? Suggest risk-management content or a break notification.

3. Integrate emotional analytics.

Track what traders feel through what they do:

-

Holding time after losses vs. wins.

-

Deposit behavior after a drawdown.

-

Trade volume correlation with volatility spikes.

These signals form the behavioral pulse of your brokerage.

The ROI Side: Why Understanding Trader Psychology Pays

Behavioral awareness isn’t just ethical or interesting; it can also be profitable.

Here’s what brokers gain when they align CRM data with trader psychology:

-

Higher Retention: Traders who feel “understood” by the system stay longer.

-

Lower Risk Exposure: Detecting reckless behavior early prevents margin calls and bad debts.

-

Smarter Marketing: Behavioral segmentation enables hyper-personalized campaigns.

-

Better Lifetime Value: Traders with healthier habits trade more consistently and sustainably.

In fact, brokerages that integrate behavioral metrics into CRM analytics can reduce churn by up to 30% and increase conversion by up to 25%. That’s not theory; it’s a bottom-line outcome.

Ethics: Using Psychology in Forex CRMs

Let’s be clear: behavioral data shouldn’t be for manipulation purposes, but rather an empathy tool.

When brokers use CRM insights responsibly (to educate, to stabilize, to personalize) they don’t exploit emotion; they guide it.

The goal isn’t to make traders trade more. It’s to help them trade better.

And that builds TRUST - the most undervalued currency in Forex.

The Future: A Human-Centered Brokerage

The future of brokerage tech isn’t just automated; it’s aware.

A CRM that senses the pulse of trader behavior, anticipates emotional spikes, and guides engagement with precision will define the next era of growth.

Because trading isn’t only about logic and leverage. It’s about people navigating risk, reward, fear, and dopamine. The brokers who design for that reality will lead.

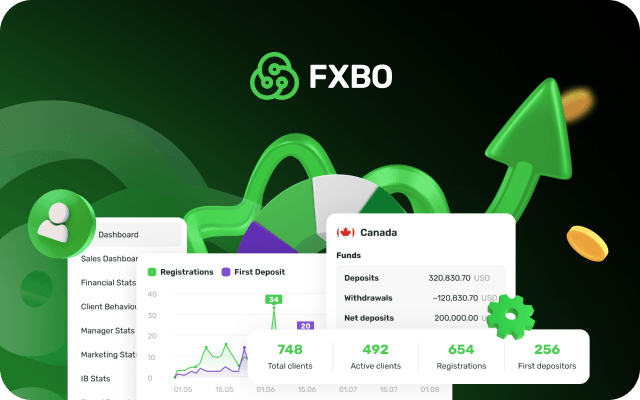

FXBO CRM gives you that advantage with tools built around human behavior:

-

Smart reporting dashboards that visualize client patterns in real time.

-

Workflow automation that responds to trader actions automatically.

-

Integrated risk management that flags emotional trading spikes early.

Ready to move from data-heavy to human-smart? Request your FXBO CRM demo today!