Automated trading is like putting a place under fluorescent lighting.

In soft light, imperfections disappear, edges blur, and things feel acceptable.

Under harsh light, nothing new appears, but everything becomes visible: Uneven surfaces, poor alignment, and corners that were never finished properly.

Forex robots and EAs (Expert Advisors) do exactly that to a brokerage. They remove discretion, mood, and tolerance. What remains is the raw shape of execution, rules, and infrastructure, repeated until it either holds or cracks.

Some brokers welcome that exposure, while others spend a lot of time dimming the lights.

So, the real question is not whether brokers “allow” robots. The question is whether brokers support them in practice, or simply tolerate them until the flow becomes inconvenient.

Quick explainer: What is an EA, and What is a Forex Robot?

Think of this as the five-minute refresher.

What is an Expert Advisor?

An Expert Advisor, usually shortened to EA, is a piece of automated trading software that runs inside MetaTrader. It sits on a chart, listens for events like new price ticks, and can send orders to the broker’s server based on predefined logic.

What is a Forex Robot?

In everyday broker and trader language, “forex robot” is often the umbrella term. It typically refers to any automated trading system that can analyze prices and place trades without manual clicking. In the MetaTrader world, that usually means an EA. MetaTrader itself uses the language of “trading robots” in its automated trading materials, which helps explain why the terms blur together in the wild.

What is the relationship between EAs and Forex Robots?

In practice:

-

Most forex robots used by retail traders are EAs, because MetaTrader is a dominant retail platform for automation.

-

Not every robot is an EA, because automation can also live in other platforms, APIs, or custom execution stacks.

-

When a trader says “my robot,” a broker usually hears “a high-frequency, consistency-demanding client” whether it is technically an EA or not.

Automation is Not a Niche Anymore

Zoom out for a second. In FX broadly, electronic execution and automation are deeply embedded in how trading works, not only for retail. Global FX activity itself has grown, which usually means more complexity, more venue competition, and more reliance on automation to move size efficiently.

The BIS 2025 Triennial Survey reports that OTC FX turnover averaged $9.6 trillion per day in April 2025, a 28% increase from the 2022 survey.

Retail EAs are not the same thing as institutional execution algorithms, but they share one important trait: they turn execution quality into a measurable product. You cannot hide behind vibes when your clients are running scripts.

What “supporting EAs” Looks Like for Forex Brokers

If a forex broker truly supports automation, whether forex robots or EAs, you will see it in four places.

1) Platform Reality: The broker is not the bottleneck

MetaTrader is explicitly designed for algorithmic trading, including tools to develop and run EAs, plus a marketplace for distribution.

A broker that supports EAs behaves as if automation is a first-class user:

-

stable trade server connectivity

-

predictable order handling under load

-

transparent platform settings that do not sabotage automated execution

A broker that merely tolerates EAs usually has “EA friendly” in marketing and friction everywhere else.

2) Infrastructure: Consistency beats speed

Most automated strategies do not live or die on heroic microseconds. They live or die on whether execution is consistent enough to evaluate.

Support looks like:

-

guidance that reduces disconnect risk and terminal instability

-

infrastructure choices that limit random performance cliffs

-

operational readiness for bursts, especially during volatile events

This is also why VPS offerings keep showing up as a retention tool. It is not always about speed. It is about keeping the environment stable enough that results make sense.

3) Rules: The broker draws a clean line between automation and abuse

A broker can support EAs and still restrict specific practices that are designed to exploit execution mechanics rather than take market risk.

Latency arbitrage is a common example, typically described as exploiting time delays between price feeds.

The problem is not the existence of rules. The problem is when rules are:

-

vague enough to be weaponized

-

enforced retroactively

-

explained in language that no engineer could design around

EA support without rule clarity is not support, rather a future dispute.

4) Governance: Automation turns weak controls into real damage

Regulators have been focusing on algorithmic trading controls, because speed and complexity amplify failures. In August 2025, the FCA published a multi-firm review with high-level observations on algorithmic trading controls, reflecting ongoing attention to governance, oversight, and control frameworks in algorithmic environments.

Even if retail brokerages are not principal trading firms, the lesson still applies: if you cannot monitor, document, and control automated behavior, automation will eventually control you.

Why Forex Brokers Love Robots, Until They Do Not

EAs are a volume engine, and volume is oxygen for many brokerage models. They can also be operationally efficient because a bot does not need hand-holding.

But automation has three pain points that separate serious brokers from wishful ones.

1-Toxic Flow Risk

Some automated strategies are built to exploit broker infrastructure, stale pricing, or feed delays. Supporting EAs does not mean subsidizing strategies designed to extract value from your plumbing.

2-System Strain

Automation compresses time and multiplies message rates. A handful of aggressive robots can create disproportionate load, which becomes a resilience issue if your stack is not built for it.

3-Client Expectation Inflation

Robots are constantly sold as a shortcut to profitability, which creates unrealistic client expectations. When the robot fails, the broker often becomes the emotional support desk for someone else’s marketing.

A Simple Test: Is the Broker Supporting EAs or Merely Permitting Them?

Here is the tell.

A broker that supports automation will usually provide:

-

clear and specific policy boundaries, not vague warnings

-

execution transparency, especially during volatility

-

infrastructure guidance that treats automation as normal, not inconvenient

-

monitoring and controls that keep automation safe for the broader client base

A broker that merely permits automation will usually rely on:

-

marketing claims with little operational follow-through

-

unclear restrictions that appear only when flow becomes uncomfortable

-

reactive support and inconsistent enforcement

What Brokers Should Do If They Want to Embrace EAs?

If you want to attract serious automated traders, the strategy is not to say “we allow EAs.” Everyone says that. The strategy is to become measurably easier to run automation with.

That means:

-

Document rules like an engineer will read them, not like a lawyer is hiding behind them.

-

Design for consistency under stress, because volatility is where your promise gets audited.

-

Treat monitoring and incident response as product features, since automated traders demand coherence, not comfort.

-

Educate without patronizing, because the fastest way to lose serious traders is to sound evasive.

Automation is Not the Enemy

Automated traders are not asking brokers for anything Sci-Fi. They are asking for an environment that behaves predictably.

If you support them properly, robots become retention logic because sophisticated clients stay where results are measurable and rules are legible. If you support them badly, robots become a daily stress test that will surface every weak seam in your execution stack.

In an FX market that is growing and increasingly shaped by automation, supporting EAs is not a checkbox feature but an operational posture.

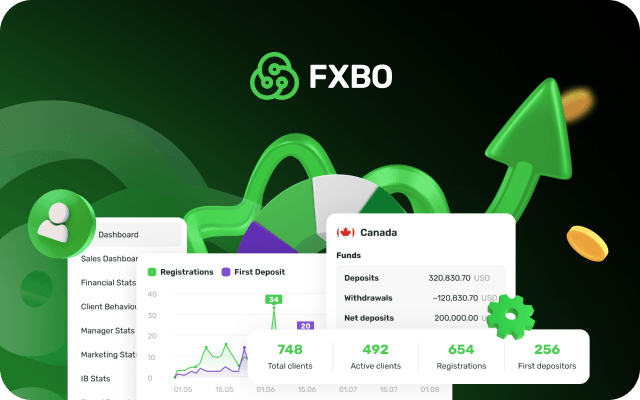

This is why you need to choose the right powerhouse CRM that carefully weighs automation for you as a growth tool. FXBO CRM is ISO-certified and known as the “ultimate forex CRM” for a reason. Request a free demo today and figure out why.