Let’s talk about Forex CRMs, but before you say, "Oh no, not another tech talk" hear me out! This isn’t just a guide for picking software; this is your battle plan for survival in the competitive world of forex trading.

Choosing the right CRM for your brokerage is like choosing the right sword in battle—pick the wrong one, and you’ll be watching your clients run to your competitors faster than you can imagine. Does that metaphor sound too dramatic? Well, because the situation is!

In this article, we’re going to dive into the top five mistakes forex brokers make when choosing a CRM and, more importantly, how to fix them.

Mistake #1: Picking a CRM That’s Not Customizable

One size definitely does not fit all in the forex world, and yet, many brokers settle for CRMs that can’t be customized to their needs. You wouldn’t wear shoes two sizes too small, so why settle for a CRM that doesn’t fit your business?

How to Fix It:

Choose a CRM that’s flexible and customizable. Look for features that let you tweak the user interface, adapt workflows, and integrate with your existing platforms (think MT4, MT5). A customizable CRM means you’re not locked into rigid processes—it’s like a pair of sneakers you can wear to both the gym and a business meeting.

Having a CRM that grows with you is crucial, especially in a fast-paced market like forex, where client preferences and market dynamics can shift overnight.

Mistake #2: A CRM that Neglects Compliance

Forex trading is a tightly regulated space, and ignoring compliance features in your CRM is like walking into a lion’s den wearing a meat suit. It’s a bad idea. Without the proper tools to handle KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, you’re setting yourself up for potential legal headaches, fines, or worse.

How to Fix It:

Ensure your CRM comes with robust compliance management features. Automation of KYC and AML checks is a must in today’s regulatory environment.

Look for CRMs that keep you updated on the latest regulatory changes, have built-in reporting tools, and can flag potential risks before they become full-blown disasters. It’s all about keeping the regulators happy while maintaining smooth operations.

Mistake #3: Forgetting to Train Your Sales Team

You’ve spent a small fortune on a shiny new CRM that has every bell and whistle imaginable. But here’s the thing: your sales team doesn’t know how to use it. It’s like buying a Ferrari and only driving it in first gear.

How to Fix It:

Training, training, training. When you implement a new CRM, don’t just throw your sales team in and expect them to figure it out. Take the time to offer proper training so they can leverage every feature.

The better they know the system, the more effectively they can track leads, manage customer interactions, and—most importantly—close deals.

Think of it like this: a well-trained sales team using a top-tier CRM is like a well-oiled machine. You’ll see smoother processes, faster client onboarding, and happier customers.

Mistake #4: Not Updating Your CRM Regularly

Technology moves fast, and sticking with an outdated CRM is like trying to trade manually while everyone else is using high-speed algorithms. Outdated systems often lack the latest security patches, integrations, and features. Now that puts you at a huge disadvantage.

How to Fix It:

Regularly update your CRM to the latest version. Many modern CRMs offer cloud-based solutions that automatically roll out updates, ensuring you’re always working with the most current tools. Plus, keeping your CRM updated will help protect your business from potential security breaches and keep your operations running smoothly.

Here’s the truth: your competitors are probably already doing this. So, if you’re not, you’re going to be left behind!

Mistake #5: Focusing Only on Client Acquisition

Let’s be honest—finding new clients is exciting. But did you know it’s five times more expensive to acquire a new client than to keep an existing one? That’s why focusing solely on client acquisition without putting equal effort into retention is a huge mistake.

How to Fix It:

Your CRM should have built-in tools to help you with client retention. From personalized email campaigns to tracking client behavior, the right CRM can help you stay connected with your clients, anticipate their needs, and keep them happy.

A happy client is a loyal client, and a loyal client is worth their weight in gold. By using CRM tools to enhance client relationships, you can boost retention rates and increase lifetime value, turning one-time traders into repeat customers.

Bonus Tip: Don’t Forget About User Experience!

A CRM packed with features is great, but if it feels like navigating a maze blindfolded, your team will struggle. Ease of use is so crucial.

How to Fix It:

Look for a CRM that balances functionality with user-friendliness. Your team should be able to navigate the system easily, access client data in a snap, and manage workflows without pulling their hair out. A clean, intuitive interface will boost productivity and reduce the learning curve. Even your clients should be able to use it in their sleep - okay that’s an exaggeration, but you got the point.

Final Thoughts

Choosing the right CRM is one of the most important decisions you’ll make as a forex broker. Avoiding these common mistakes—selecting rigid systems, neglecting compliance, skimping on training, ignoring updates, and focusing only on acquisition—will set you up for success. And remember, a good CRM is more than just a tool; it’s a partner in your business’s growth.

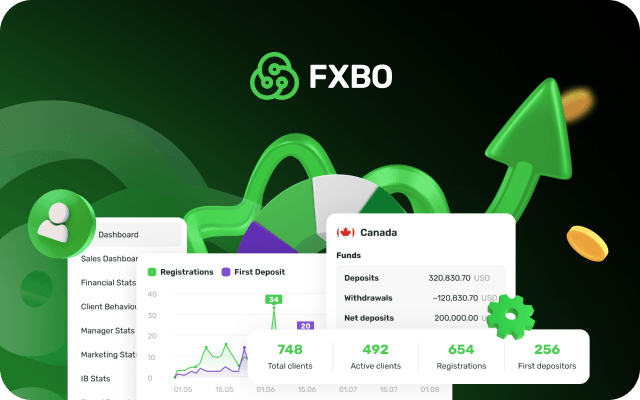

So, the next time you’re in the market for a CRM, think beyond just features. Think about flexibility, compliance, ease of use, and—most importantly—how it can help you build better, longer-lasting relationships with your clients. And guess what? FXBO CRM has been credited as the ultimate Forex CRM. Don’t just take my word for it, so request a demo and figure out why.